The Secret to a Lucrative Credit Repair Business

Traditionally, a credit repair business follows a subscription-model where clients pay you a monthly fee for “document processing” and “credit education.” When we think of subscriptions, we think of magazines, but another example are razor blades. Buy a razor and every so often you’ll to buy new blades for it. The “subscription” model is follows a simple proven recipe: If you can keep happy clients paying you monthly and a cost-effective way to attract more, your recurring revenue will quickly multiply.

The “Recipe”

Keeping existing clients happy (and maintain a low churn rate).

Increasing your flow of leads is definitely important, but always remember that the most valuable clients are the ones you already have. Keep them happy. Happy clients have the longest lifecycle and highest lifetime value (and they’re your best advertising).

Monitor the health of your business

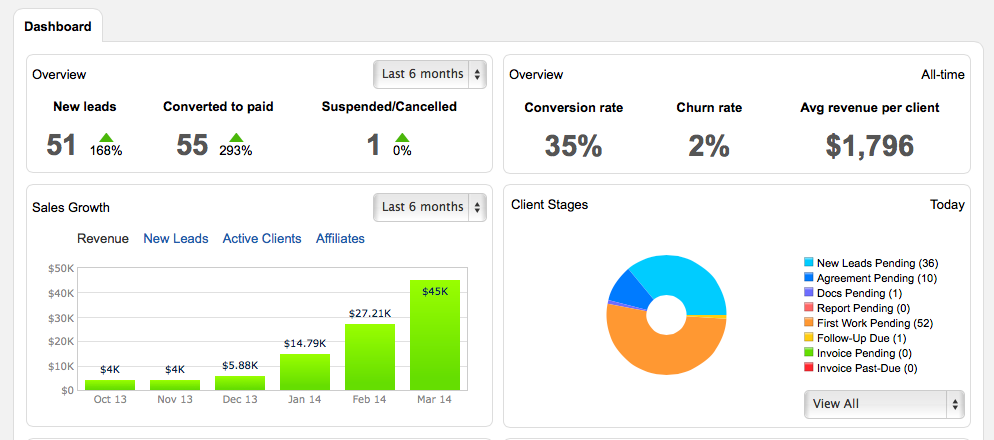

Use your Business Dashboard to monitor your conversion rate, churn rate and average revenue per client, as these are the the KPIs (key performance indicators) that show the health and profitibility of your business. Average revenue helps you to determine a budget for customer acquisition. Spikes in cancelations or high churn are indicators of unhappy clients and a problem on your team.

The first step with software is to understand the flow

After entering a client into Credit Repair Cloud, the work is minimal. The software automates and simplifies the work, keeps it organized, reminds you for follow-ups and the Business Dashboard monitors your clients, your affiliates, your team and the overall health and profitability of your business. Using software will reduce your workflow and cost (which is important to scale a business), but software can only work if you follow the flow.

The Flow:

- New lead appears in your credit repair cloud (from your website or your affiliate) or lead calls and you add them manually.

- Your sales person converts that Lead to Prospect and then finally to Client.

- Creating a client profile is when you sent client portal login details to the client.

- Collect necessary documents from the clients: Photo ID, Utility Bill and Power of Attorney letter (optional)

- Order all 3 reports and scores (usually the client does this with an online service like PrivacyGuard.com)

- Examine the reports for for errors. If you’re using credit report import, tag and save all the items you wish to dispute.

- Use the dispute wizard to create dispute letters to send to credit bureaus. Never dispute more than 5 items in a 30 day period. The biggest companies in Credit Repair limit disputes to 2-3 items per month.

- Wait for 30 days while the bureaus investigate and respond. Items are either removed or verified

- If bureaus respond that the item is verified, challenge the verification. Lather, rinse, repeat.

- Occasionally communicate with creditors directly. Same rules apply.

- Add more affiliates that refer clients to you, add more team members to do the processing.

- Keep clients happy so they will continue monthly service and they will tell others how awesome you are.

- Monitor the business dashboard for trends such as unusual drop-offs of active clients or high churn rate as these are strong indicators of unhappy clients or a problem on your team.

Credit repair cloud has tools to manage your team, your clients, your affiliates (who refer clients to you) and to monitor the overall success and profitability of your business. It also has tools to communicate securely with clients and affiliates with a secure portal they can log into for real time status of the progress of your work. The beauty of the client portal is that it saves you from unnecessary calls asking for status updates. Click here to view portal demos.

The Bottom Line

Building a successful business does take work and testing. Credit Repair Cloud has all the tools to manage your business, to minimize your workflow and maximize profits and scalability.

Give ’em the pickle!

Your existing customers are your greatest asset. Keeping them happy will increase your revenue and profitability. Here’s 3 minutes of great and simple advice for anyone with customers.

.

.

Using the Credit Repair Cloud API to integrate with other software

One of the most exciting benefits to cloud computing is that cloud applications can share data by API. It’s important to know that this is new technology for all software companies . You can only do a certain task by API if that API call actually exists. Each software has their certain limitations and some may be for security concerns. As a result, some don’t play well with others. All popular cloud based software companies are working to increase functionality of their APIs for what they can do.

Here are examples of how one of our biggest customers uses our API:

- Their Sales Team enter all new clients directly into their custom in-house CRM.

- Their CRM sends an API call to Credit Repair Cloud automatically creating a new client in Credit Repair Cloud.

- When they change a client’s status in their CRM (such as; client was suspended because he didn’t pay a bill, etc.), that client’s status automatically changes in Credit Repair Cloud.

- This same company handles their client payments and accounting with other software. They primarily use Credit Repair Cloud as a tool to handle the automation and organization of the credit repair work (and the secure client portal for clients to send documents and monitor status).

To build API integrations like these you’ll need a developer.

Your developer will look at the various software you wish to integrate and see what’s possible. To show your developer what API calls are available, show them the the API pages in your Credit Repair Cloud. For issues with any other company whose software you want to integrate with, it’s important to remember that they will have their own support team to help you.

Status of our API and FAQ’s about integrations

This is our year to focus on integrations. This year we’ve enabled Credit Repair Cloud to talk with hundreds of other cloud applications including MailChimp, SalesForce.com, ZOHO, Infusionsoft, QuickBooks, FreshBooks, Zapier and more. This week we’re launching a Mandrill integration to give you complete control over all the emails sent from your Credit Repair Cloud to your clients and affiliates. This is the 2nd most requested feature we’ve ever had (after Credit Report Import). We have many more planned.

Can Credit Repair Cloud process my client’s payments? No. Credit Repair Cloud is a great tool for credit repair and it does have basic invoicing and accounting tools, but it is not a payment processor and it cannot take your client payments. If you have a merchant account for credit repair, you already have tools from your gateway to accept payments and ACH transfers. For our own recurring payments and billing we use a service called Recurly and they are awesome. We don’t see or store credit card numbers. For certain high risk tasks it’s best to go to a company who specializes in such things. If you use an online accounting system like QuickBooks or FreshBooks or your CRM, you may be able to keep your Credit Repair Cloud updated on payment status by API. This is all up to you, your other software and your developer. We are exploring the idea of adding payment processing functionality as a feature in the future, but we do not offer it at this time.

We just completed integration with Zapier. Zapier is like match.com for cloud apps and it’s AWESOME! If you have ZOHO, Salesforce.com or another popular CRM or if you use QuickBooks or FreshBooks to manage your accounting, those applications (and many more) can talk to Credit Repair Cloud via our Zapier (in a shorter time without having to write code).

Adding new API calls and integrations is our primary focus this year. If you have any suggestions of integrations you’d like to see, post them on our uservoice page by clicking Help & Support > New Feature requests. Other users vote on them, we discuss them at developer meetings and many are added. When they launch, we post them on the New Features Page. This is how we grow.

Professional Resources

Need Credit Repair Education? Visit American Credit Repair Academy for the 3 hour Credit 101 course and certificate. It’s affordable and important to learn the correct steps and how they relate to the law.

Need Software Training? Schedule a session with Keenan for 1-on-1 assistance to set up your account, set online agreements, import credit reports, set up a website and more. If you’re just starting out and need personalized help, we recommend Keenan.

Need Credit Card Processing? Get a Merchant Account for Credit Repair. Process Credit Card Payments and ACH Transfers from your clients.

Need a website for your business? Get a professional Credit Repair Business Site today!

Click here for more professional credit repair business resources.