Credit Repair Business Startup and Marketing Guide

For Credit Repair Business Software Users

CONTENTS (click

to jump to any section)

WELCOME TO THE AMERICAN CREDIT REPAIR ACADEMY

AMERICAN CREDIT REPAIR ACADEMY COURSES

A CREDIT-REPAIR “MINI-SESSION”

Mini-session length and content

What if I already know and understand basic credit

repair?

Preparing for this course (before your session please

do the following)

Being prompt with your training appointments

THE “CREDIT-REPAIR 101” COURSE SYLLABUS

What if I already know and understand basic credit

repair?

Preparing for this course (before your session please

do the following)

Being prompt with your training appointments

Your Certificate of Completion..

NOW IS THE TIME TO START A CREDIT REPAIR BUSINESS

Credit repair brings in new streams of revenue and

passive income

Get a copy

of your own credit report to study

Learn

everything you can about the Credit Reporting System

Understand

your role in the process

Understand

what you are selling and be careful what you promise.

Work smart

and minimize the number of hours you spend working

HOW TO

PROMOTE AND MARKET A CREDIT REPAIR BUSINESS

ADDITIONAL

WAYS TO MARKET CREDIT REPAIR

Magnetic

Sign on the side of your car

Local

Newspaper Ads, Shopping guides

Internet

ads, Craigslist Ads, YouTube, Your own web site.

Start small

and work out the kinks before you expand too quickly.

Download your Bonus Materials.

If you don’t have Microsoft Publisher

These items

are given to the client at the first meeting:

HOW TO BOOST A CREDIT SCORE IN 7 EASY STEPS

1) Correct all errors on

the credit reports

2) Be sure that proper

credit lines are posted on the credit reports

3) If you have negative

marks on the reports, negotiate with the creditor/lender

4) Pay all credit cards

and revolving credit down to below 30% of the credit line

5) Don’t close your old

credit card accounts

6) Avoid applying for

new credit

7) Maintain at least

three revolving credit lines and one active (or paid) loan

Credit Repair Business Websites.

What is the statute of limitations for debt

collection?

What are the Credit Repair Organization laws for my

state?

Do I need a special license for Credit Repair?

What is the statute of limitations for debt

collection?

Help! I can't download my free credit reports from the

credit bureau site!

RESOURCES FOR CREDIT PROFESSIONALS

©2012

Credit-Aid Software/American Credit Repair Academy. All rights reserved. Reproduction,

adaptation, or translation of this document without prior written permission is

prohibited and is protected under the copyright laws. Credit-Aid Software is a

registered trademark of Daniel Rosen Inc. All other trademarks are the property

of their respective owners. Windows® is a registered trademark of Microsoft

Corporation in the United States and other countries. Credit-Aid™ Software and

the American Credit Repair Academy’s intended use is to help you learn to

automate the process of cleaning up your credit history reports. Credit-Aid

Software and The American Credit Repair Academy courses are not sold in the

State of Louisiana. Credit-Aid Software and American Credit Repair Academy

provide Credit Information, not legal advice. For legal questions about

specific issues regarding your credit, consult an attorney.

HOW TO USE THIS GUIDE

Welcome to the American Credit Repair Academy!

This is your course outline for Credit-Repair 101.

We recommend reading this before your course begins, so you will have an understanding of our method and the tools available to you.

You can navigate through this guide using the table of contents in the PDF reader interface, or just read it straight through. You can also jump around using links, which are formatted in light blue text. You’ll come across links to webpages that look like this: www.americancreditrepairacademy.com . Just click them, and your default web browser will open the page and display additional information.

We hope this helps! If you have any questions, comments, or suggestions about how this guide can be improved, we’d love to hear them.

![]()

|

WELCOME

TO THE AMERICAN CREDIT REPAIR ACADEMY

About the Academy

In

our many years of developing professional credit repair software, the two

questions we receive the most are: "do you offer credit

repair training?"

and "where can I

find a credit repair school?" In researching the answer, we discovered that we could not find

a complete school offering professional credit repair training, coaching or

mentoring. It did not seem to exist on a professional level.

In

our many years of developing professional credit repair software, the two

questions we receive the most are: "do you offer credit

repair training?"

and "where can I

find a credit repair school?" In researching the answer, we discovered that we could not find

a complete school offering professional credit repair training, coaching or

mentoring. It did not seem to exist on a professional level.

America is

now recovering from our great recession and millions of Americans need your

help. There has never been a better time in history to learn credit repair or

to run a credit repair business. These are skills that all real estate and

finance professionals must learn. Since you cannot process a loan unless the

score is high, credit repair has now become a necessary survival skill to stay

in business. If you can learn to raise a credit score you will close more

loans, sell more houses, lower your clients' bills and credit card rates and do

a great service to your community. Credit restoration is a business opportunity

you can truly start with nothing but a phone and a computer. It's a business

startup with zero overhead and it earns immediate revenue.

CREDIT-AID™ continually studies global financial

trends. The need for a professional credit repair school was imminent and

inevitable. We found that great instructors in such a highly specialized field

were few and far between. In 2007 we met Denise Wayne. Denise had an extremely

successful credit restoration and consulting business. However she was lacking

software to automate her dispute system and speed up her process. We introduced

her to Credit-Aid™ Pro Software. The software enabled Denise to quadruple her

workload. She then began to recommend it to the credit specialists she was

training. These clients, in return, began to tell us how much they were

learning. Since we didn't offer training, we began to refer our Professional

customers to Denise. With the influx of students, Denise realized how much more

she could accomplish in her teaching and consulting.

In 2010 we

founded The

American Credit Repair Academy.

Daniel Rosen

Daniel Rosen

Founder

Credit-Aid Software

AMERICAN

CREDIT REPAIR ACADEMY COURSES

A CREDIT-REPAIR “MINI-SESSION”

Mini-session

length and content:

If you have purchased Credit-Aid Pro Software you will

receive a training mini-session. A mini

session is 20 minutes and has a flexible curriculum. For many students, that time is spent going

over basic points of credit repair and answering basic questions regarding

credit repair, using the software and available services.

What if I already know and understand basic credit repair?

We have students of every level, beginner to advanced. You

may already have a working knowledge of credit repair basics. Therefore, if there is a certain specific

item you would like to spend your mini-session on, please let us know at the

start of your mini-session, so we can spend the time on you the topic you

desire.

Preparing for this course (before your session please do the following)

· Read this guide. You may want to print it out.

· Have a fresh set of credit reports (a client’s report or your own).

· If you’ve purchased Credit-Aid Pro Software be at the computer with it installed.

· Have your learning environment free from noise or distraction.

· Understand that courses are 1 on 1, unless other arrangements are made.

Being prompt with your training appointments

Everyone’s time is valuable. This is a live training course and we set aside blocks of time just for you. Of course emergencies sometimes arise, but if you must cancel, please give at least 12-24 hour advance notice so we can fill the slot with another student. Without appropriate and considerate notice, missed blocks of time will be deducted from the remainder of your course.

Additional courses

No one can learn a new business in 20 minutes. If you’ve only signed on for a mini-session, we highly recommend further training.

THE “CREDIT-REPAIR 101” COURSE SYLLABUS

What if I already know and understand basic credit repair?

We have students of every level from beginner to advanced. Everyone has a specific need so we have established a flexible curriculum. You may already have a working knowledge of credit repair basics. Therefore, if there is something listed here that you already know, it can be skipped over to allow for more time on the topics you desire or your own specific questions. Please let us know at the start of your session, so we can tailor your course to fit your needs.

Preparing for this course (before your session please

do the following)

· Read this guide. You may want to print it out.

· Have a fresh set of credit reports (a client’s report or your own).

· If you’ve purchased Credit-Aid Pro Software be at the computer with it installed.

· Have your learning environment free from noise or distraction.

· Understand that courses are 1 on 1, unless other arrangements are made.

Being prompt with your training appointments

Everyone’s time is valuable. This is a live training course and we set aside blocks of time just for you. Of course emergencies sometimes arise, but if you must cancel, please give at least 12-24 hour advance notice so we can fill the slot with another student. Without appropriate and considerate notice, missed blocks of time will be deducted from the remainder of your course.

Topics covered:

First Hour

· Working with New Clients.

· Answering common questions from Clients (such as “why go to a credit repair specialist when they can do it themselves”).

· Obtaining the proper information to start your client file.

· Best practices for obtaining Credit Reports.

· Reading a credit report and understanding all the codes.

· Spotting Identity Theft and determining information to report to the police dept. when making a claim.

· “Identity Theft” vs. “Mistaken Identity” (and appropriate methods of removal).

· When to dispute tradelines to the Credit Bureaus and when to dispute directly to the Creditor.

· Avoiding frivolous letters from the Credit Bureaus.

· Q and A throughout.

Second Hour

· Advanced Tips and Tricks for removing Bankruptcy’s, Foreclosures, and Short sales.

· Four items that have no Statute of Limitations.

· Properly worded explanations that work to remove an item.

· The difference between “Collections” and “Recovery.”

· Violations of collections and recovery.

· Removing lates.

· How to speak with creditors, collections and attorneys. What to say (and what not to say).

· Q and A throughout.

Third Hour

· How to obtain fees and stay within the law.

· What a lender looks for.

· Answering common questions from your clients (for example: regarding length of time it takes to repair someone’s credit).

· Rapid Rescoring: How it works, where to obtain it and when to use it.

· The “Business” of Credit Repair: Where to find clients, marketing tips and ideas.

· Attracting and working with “Affiliates” and scaling your business. Denise’s 1 hour method.

· Reviewing a credit report (advanced and in depth).

· Q and A throughout.

Your Certificate of Completion

Be sure to give us the address to send your certificate!

NOW IS THE TIME TO START A CREDIT REPAIR BUSINESS

Starting a credit repair business is easy and your timing couldn’t be any better for this lucrative business opportunity. Over 80 million Americans have poor credit. Most do not understand the credit reporting system and will gladly pay good money for someone to help improve their credit. Why shouldn’t that be you?

A credit repair business is one business that will always earn a profit. Even in the most troubling economy, a credit restoration business will succeed and prosper. Nearly eight out of ten Americans struggle with their finances. This very quickly takes its toll on their credit worthiness. Maintaining good credit is a necessity in our society and during troubling times, people tend to rack up more debt and fall behind.

With so many people in need (and that need growing daily), a credit repair business is also an ideal home-business. It needs no certification, requires very little investment, is easy to do (if you keep organized and follow the simple rules) and it generates revenue immediately. It’s also the ideal home business with close to zero overhead.

A credit repair business

· Is recession-proof

· Excels during tough economic times

· Is easy to run from your home

· Can make you money immediately

· Is easy to start with very little investment

· Pays for itself after just a few clients

· Is a great supplement to your existing business and clients.

· Does a service for your community.

Credit repair brings in new streams of revenue and

passive income

Learning the basics of credit repair enables you to start a new business immediately. It’s something you can easily do in your home or office because all you need is a computer, a phone and a printer. Helping others repair their credit history and have a fresh new head start on life is extremely rewarding. While it’s true that consumers can do this very same work themselves, most are afraid or lacking the skills to communicate with credit bureaus and negotiate with creditors. This is where you come in to help.

STEPS TO LAUNCH YOUR BUSINESS

Get a copy of your own credit

report to study

You are entitled to one free

copy a year, and there are three major credit bureaus to see reports from:

Equifax, Experian and Trans-Union.

Learn everything you can

about the Credit Reporting System

Read the Fair Credit

Reporting Act and the Fair Debt Practices Act (in your bonus materials. Read

and study as much as you can.

Understand your role in the

process

Once you obtain your clients

credit reports, you can then work with that client to correct any mistakes,

acting as the intermediary between them and the credit bureau or creditor.

Understand what you are

selling and be careful what you promise.

A credit repair company

cannot claim to “erase” negative items that are accurate and have been present

on a credit report for less than seven years. However, many accurate but

negative items can be removed with a bit of finesse if you learn the right

negotiating tactics and approach the creditors and collection agencies in the

proper manner. Here’s the good news: 79%

of all credit reports contain errors. This means that MOST credit reports contain

errors. Those errors come off very easily with a few clicks of your mouse.

Simply removing errors will improve a score almost immediately. Once you’ve

accomplished that, you can further enhance a credit report by negotiating the

remaining negative items.

Work smart and minimize the

number of hours you spend working

The most common mistake more

entrepreneurs make is in managing their time poorly. Time spent creating

dispute letters and handling paperwork can eat up hundreds of hours and drop your

hourly earnings very low. This is where software comes in handy. It can help

you to work “smart” by saving you hundreds of hours by automating.

HOW TO PROMOTE AND MARKET A

CREDIT REPAIR BUSINESS

Now that you have everything

in place, it’s time to start promoting and marketing your credit consulting

business.

Call other local credit

repair businesses to get an idea of the services they offer and the types of

fees associated with these services. In our own PRO software we give a breakdown

of suggested fees. Some credit repair specialists don’t charge fees at all. For

mortgage brokers and auto dealers the reward can be greater in generating leads

and closing more loans. Go through all the information you can find, decide on

your fees and services, and get ready to advertise.

Dress professionally and meet

with local merchants who deal with financing: mortgage brokers, real estate

agents, auto dealers, etc. If you’ve

signed up for a Crediit Repair Cloud and have a credit repair business website, this will be a

plus. Many mortgage and real estate

professionals will require you to have a portal and a site before referring

clients to you.

Create flyers, brochures and

business cards. Give a brief description about your services and contact

information. We already provide these in the Credit-Aid Pro Bonus materials. Post

flyers everywhere you can. You may also want to place small ads for your

services in local newspapers, church newsletters and periodicals.

Offer friends and family your

credits repair counseling services for free, and then ask them for a letter of

recommendation. This will quickly help to build your client base. Word of mouth

is the very best kind of advertising.

You may want to consider

giving credit repair and debt seminars or classes to teach people how to help

themselves. Give talks at high schools and colleges about ways to stay out of

debt. The students will go home with the information you have given them, plus your

business card or brochure and tell their parents, who could end up as your next

clients. We have many customers who give seminars and buy our software in bulk to

resell or give to attendees.

ADDITIONAL WAYS TO MARKET

CREDIT REPAIR

Billboards

These are great to be seen

every day by the drivers passing by, but traditional billboards can be very

expensive, however we are also starting to see small portable billboards on the side of the road. These are a nice affordable alternative.

Mini Portable Billboard

![Description: Description: Description: Description: 20091030_080349_do31-trailer[1].png](images/credit_repair_business_startup_and_marketing_guide_files/image018.jpg)

Magnetic Sign on the side of

your car

These really work! Everywhere you go, people will see this and

you can’t beat the price!

Flyers and Brochures

These are also excellent

affordable ways to advertise your business. You might try hanging them in restaurant and shop windows, grocery

stores, laundromats, a local college, on light poles, bulletin boards,

etc. Make sure you are aware of the laws

in your city and that you are not violating them by placing your marketing

material where it is not allowed. Also

consider offering your marketing materials to referral partners like

accountants, auto dealers bankers, financial planners, mortgage brokers, real

estate agents, etc. Their clients are in

need of your business. Some credit

repair companies pay for these referrals.

Local Newspaper Ads, Shopping

guides

Newspaper ads can often be

very affordable. As with all marketing,

your job is simply to get your services in front of as many people that need

them as possible.

Internet ads, Craigslist Ads,

YouTube, Your own web site

You can’t beat free

advertising!

Direct Mail Marketing

This

can become costly and they can be difficult to track, so test in small

quantities first. Create 5 -10 possible

direct mail pieces and then try sending them out in groups of 200.

Evaluate the productivity by assigning different 800 phone numbers or website

addresses. Be creative! Think about where your customers would be,

what they would be reading, looking at, etc. and then place your services in

front of them.

Additional Marketing Ideas

Promote your credit repair

business vigorously. Advertise, and offer bonuses to raise awareness of your

business - such as free counseling, free consultations, free credit report

assessment, lotteries, quality information and resources, and so on. It's not

difficult to establish your credit repair business and make money, provided you

keep the interest of your client as the most important aspect of the business. Always

start with someone close. Start with

friends, family and colleagues. That

will get the word of mouth rolling. Go out of your way to do an exceptional

job! Your good work will be rewarded by word-of-mouth promotion and endless

leads.

To kick start your credit

repair business offer a limited time discount; and make sure to give your best

effort, so those that take you up on your offer will send you more business

through referrals.

Start small and work out the

kinks before you expand too quickly.

As a credit consultant, you

should start to build your business locally before expanding too fast or going

to the internet. If you build your credibility early, when you branch out, you

will have experience and a history of customer satisfaction to back you up.

Stay honest with your

clients. You are providing them with a very important service. They must trust

you and your business. Credit repair can be confusing to many. Reassure and

give them the information they want. This will enhance your credibility and

increase your credit repair business well into the future.

If you’ve purchased Credit-Aid Pro Software be sure to download your Bonus Materials

We include Marketing Art

templates in your Credit-Aid Pro Bonus materials. In there you will find professionally

designed marketing materials (in English and Spanish) that you can customize to

make your own.

Your

bonus materials are legal documents, contracts, power of attorney, guides, marketing

materials (brochures, flyers, business card layout) and more (in English and in

Spanish). If you have any trouble opening bonus materials, you probably haven’t

downloaded the entire zip file.

Your

bonus materials are legal documents, contracts, power of attorney, guides, marketing

materials (brochures, flyers, business card layout) and more (in English and in

Spanish). If you have any trouble opening bonus materials, you probably haven’t

downloaded the entire zip file.

Microsoft Publisher

The marketing art

we provide in your Bonus Materials were created in Microsoft Publisher. To edit these files you must have Microsoft

Publisher. Microsoft Publisher comes with Microsoft Office Professional.

If you don’t have Microsoft Publisher

Download a full-functional 60 day free trial here; http://office.microsoft.com/en-us/try/ Make sure you download the one that says Microsoft Office Professional Free Trial. To work with our Marketing Art Templates be sure to get the version of Microsoft Office that has “Publisher.

Here is an alternate offer: http://office.microsoft.com/en-us/products/ and here is yet another: http://office.microsoft.com/en-us/products/get-microsoft-publisher-FX102159668.aspx?WT.mc_id=ODC_ENUS_OATPublisherHome_MonTry

These links may change over time, so check

all three.

Another alternative is to go to a local copy shop or a Kinko’s. They will also have Publisher. It’s a very common program for creating business marketing materials.

HOW DOES THIS BUSINESS WORK?

You advertise your credit

repair service. You set up a site. You

set up a client portal. You visit

Mortgage Brokers and Real Estate Agents and ask for referrals. Clients call and you schedule an appointment

with them. When you meet with a new

client, you explain the credit repair process and instruct your new client to

fill out the contracts making sure every item indicated is filled out

correctly.

These items are given to the

client at the first meeting:

·

Fee Agreement Contract (Explains your fees)

·

Consumer Credit File Rights (Explains their legal rights)

·

Client_Recommendations.rtf (Instruction on how they can do their part)

·

Fair_Debt_Practices_Act.pdf (Explains their rights)

·

Credit Services Brochure (optional)

·

Power of Attorney Letter

·

You will need to order 3 current credit

reports (1 from each bureau)

Explain your fee during your

first contact, collect your money, and give your client a receipt. What to charge your client is completely up

to you. Some charge for set-up. Others charge

monthly. Billing all depends upon your

own personal business model and the laws for your state.

After few days of the initial

meeting with your client, you will either receive the 3 credit reports…or your

client will forward (mail, fax, or drop off) their credit reports and you will

draft the dispute letters for each credit report you received from your

client. Remember to never dispute more

than 5 items at a time to any bureau within a one month period.

Wait for the results to come back

and repeat the process if necessary. Lather, rinse, repeat.

|

![]()

WHAT YOU WILL NEED

·

A

Basic understanding of how credit scores are determined.

·

A

client's 3 credit reports from all 3 bureaus (Equifax, Experian and TransUnion).

·

A

basic understanding of what it takes to repair bad credit.

·

The

ability to read write and communicate well, plus social skills.

·

Software

to automate the dispute writing process and remind you for follow-ups, and to

guide you through the process.

Have your client order a

credit report from each of the 3 credit bureaus (Equifax, Experian and

TransUnion). The Annual Credit Report Service allows you to write one letter

and receive all three reports. Ordering

a report by paper mail is the easiest. If the client orders their own credit report they will not suffer a hit

on their credit score.

Ordering credit reports is

the most important step, because nearly 80% of all reports contain errors and

those errors are most often the reason for a low credit score. Simply removing those errors will usually

raise the score immediately. Your

primary job as a credit restoration specialist is to help your client by

disputing information on their reports that you believe to be inaccurate.

Examine your client’s credit

reports and try to identify accounts that do not belong to your client. Watch

for unpaid loans that might not belong to your client because this could be a

sign of identity theft. Identity thieves

often avoid raising suspicion by first taking out loans, credit cards or lines

of credit in very small amounts. If the client never knew these accounts

existed, they remain unpaid and very quickly cause devastation to a credit

score.

Create a separate credit

dispute letter for each of the 3 credit bureaus; mail each one a letter

detailing the mistakes you have found an asking that they be corrected. If you

find anything that points to identity theft, immediately inform the police so

the theft may be tracked; it will also absolve your client from responsibility

to a certain extent.

Your business will prosper based on your success as an intermediary between the

bureaus and your client. Most people come to a credit repair business for their

troubles because they have no time or inclination to learn how it's done. So if

you wish to be in high demand you must make your number one priority to act in

the best interest of your clients. Make no mistake; this is THE key to the

success of your business.

If a report comes back and

the item you have disputed remains on the report and the bureau states that the

item has been verified, you can send a follow-up letter requesting proof and

evidence of verification. You can also

requesting a copy your client’s signature showing that the indeed entered into

the agreement that created the debt.

Credit repair software will greatly simplify the

process. The more efficiently you can streamline your work, the more time you

will have for taking on additional clients. End-user Credit repair software

(software that install on your own computer) is more advantageous than an

online website subscription because the data stays safely on your own

computer. No one else has control or can

access your client’s data. You won’t

have to worry about a web server going down at a critical time, and no one can

keep you from your client’s data. The

other thing to think about is that you pay for end-user software once and it’s

paid off immediately with the first few clients. A web based subscription service offers no

advantage and will burden you with ongoing payments indefinitely and surprise

fees.

Some important points: The

best way to make money is by ensuring that your client is happy. The rest will

simply fall into place. And finally, charge affordable fees, make unrealistic

promises, or step outside the law, regardless of how tempting it may seem.

SIMPLE RULES TO FOLLOW

·

The

best way to make money is by ensuring that your client is happy. Happy clients

refer their friends.

·

To

kick start your credit repair business, offer your services for a discounted

price for a limited period; ensure that you do an outstanding job for those who

opted for the introductory offer

·

Never

be greedy with the fee

·

Never

promise too much

·

Never

do anything that you even suspect may be illegal, however tempting and

profitable that may seem to be.

HOW TO BOOST A CREDIT SCORE IN 7 EASY STEPS

1) Correct all errors on the credit reports

Go through your credit reports very carefully. Especially look for; Late payments, charge-offs, collections or other negative items that aren't yours, Accounts listed as "settled," "paid derogatory," "paid charge-off" or anything other than "current" or "paid as agreed" if you paid on time and in full, Accounts that are still listed as unpaid that were included in a bankruptcy, Negative items older than seven years (10 in the case of bankruptcy) that should have automatically fallen off your report (you must be careful with this last one, because sometimes scores actually go down when bad items fall off your report. It's a quirk in the FICO credit-scoring software, and the potential effect of eliminating old negative items is difficult to predict in advance). Also make sure you don't have duplicate collection notices listed. For example; if you have an account that has gone to collections, the original creditor may list the debt, as well as the collection agency. Any duplicates must be removed!

2) Be sure that proper credit lines are posted on the credit reports

This is one of the most overlooked credit repair secrets. In an effort to make you less desirable to their competitors, some creditors will not post your proper credit line. Showing less available credit can negatively impact your credit score. If you see this happening on your credit report, you have a right to complain and bring this to their attention. If you have bankruptcies that should be showing a zero balance…make sure they show a zero balance! Very often the creditor will not report a "bankruptcy charge-off" as a zero balance until it's been disputed.

3) If you have negative tradelines on the reports, negotiate with the creditor/lender to remove them

If

you are a long time customer and it's something simple like a one-time late

payment, a creditor will often wipe it away to keep you as a loyal customer. If

you have a serious negative mark (such as a long overdue bill that has gone to

collections), always negotiate a payment in exchange for removal of the

negative item. Always make sure you have this agreement with them in writing.

Do not pay off a bill that has gone to collections unless the creditor agrees

in writing that they will remove the derogatory item from your credit report.

This is important; when speaking with the creditor or collection agency about a

debt that has gone to collections, do not admit that the debt is yours.

Admission of debt can restart the statute of limitations, and may enable the

creditor to sue you. You are also less likely to be able to negotiate a letter

of deletion if you admit that this debt is yours. Simply say "I'm calling

about account number ________" instead of "I'm calling about my past

due debt."

4) Pay all credit cards and revolving credit down to below 30% of the available credit line

The

scoring system wants to make sure you aren't overextended, but at the same

time, they want to see that you do indeed use your credit. 30% of the available

credit line seems to be the magic "balance vs. credit line" ratio to

have. For example; if you have a Credit Card with a $10,000 credit line, make

sure that never more than $3000 (even if you pay your account off in full each

month). If your balances are higher than 30% of the available credit line, pay

them down. Here is another thing you can try; ask your long time creditors if

they will raise your credit line without checking your Credit Report. Tell them

that you're shopping for a house and you can't afford to have any hits on your

credit report. Many wont but some will.

5) Don’t close your old credit card accounts

Old

established accounts show your history, and tell about your stability and

paying habits. If you have old credit card accounts that you want to stop

using, just cut up the cards or keep them in a drawer, but keep the accounts

open.

6) Avoid applying for new credit

Each

time you apply for new credit, your credit report gets checked. New credit

cards will not help your credit score and a credit account less than one year

old may hurt your credit score. Use your cards and credit as little as possible

until the next credit scoring.

7) Maintain at least three revolving credit lines and one active (or paid) installment loan

The scoring system wants to see that you maintain a variety of credit accounts. It also wants to see that you have 3 revolving credit lines. If you do not have three active credit cards, you might want to open some (but keep in mind that if you do, you will need to wait some time before rescoring). If you have poor credit and are not approved for a typical credit card, you might want to set up a "secured credit card" account. This means that you will have to make a deposit that is equal or more than your limit, which guarantees the bank that you will repay the loan. It's an excellent way to establish credit. Examples of an installment loan would be a car loan, or it could be for furniture or a major appliance. In addition to the above, having a mortgage listed will bring your score even higher.

ABOUT CREDIT REPAIR CLOUD

When you’re ready to launch your business, you will need Credit Repair Software. Credit Repair Cloud is a tremendous timesaver enabling you to process more clients in less time. It imports credit reports in seconds, saving you hours of typing. I organizes your entire business and your team. It keeps your client data and disputes at your fingertips and creates powerful dispute letters with a few clicks of your mouse.

Additional Enhanced Services

To help you in every way we can, we offer a suite of additional services to further enhance your software and your business. Most have free trials. Denise can answer basic questions about these products and services. Learn more at www.credit-aid.com

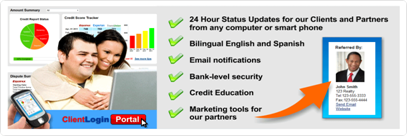

Client Login Portal – Clients and affiliate log in for 24/7 status updates and secure document exchange. No data entry required. Learn more at www.clientloginportal.com

Credit Repair Business Websites – Get an instant site with everything to launch your business. Change it all by easy point and click. Visit www.mycreditrepairsite.com

Reseller Stores – Make money selling your own brand of software in your own web store, choose your price and name your profit. Visit www.credit-aid.com/reseller.htm

FREQUENTLY ASKED QUESTIONS

What is the statute of limitations for debt collection?

It varies by state. Click here for a listing

What are the Credit Repair Organization laws for my

state?

Each state is different. Click here for a listing

Do I need a special license for Credit Repair?

No. A Credit Repair License is not required and does not exist.

Will I need a Surety Bond?

It’s possible; some states do require a bond for Credit

Services Organizations. Don’t worry about a huge fee because in most cases you

pay only a fraction of the total bond. Also in many cases, you are not required to have but the bond from

within your own state. Ask Denise for

more information, and visit www.bondsexpress.com/credit-services-organization-bond/ for information about surety bonds.

What is the statute of limitations for debt

collection?

It varies by state, click here for a listing

Help! I can't download my free credit reports from the credit

bureau site!

Credit bureau websites are unfriendly. Their goal is to make money. We have no affiliation to the credit bureaus. We provide an easy link to their websites where you can order reports, but once you are in their site we can’t control how they will respond. Viewing credit reports on a credit bureau site is dependent upon your own computer’s settings and your ability to provide the information that they request. We recommend sending report requests and especially disputes by “snail mail.” It takes bureaus longer to process disputes by snail mail which often works in your favor.

RESOURCES FOR CREDIT PROFESSIONALS

Credit Repair Cloud - The world's first cloud-based Credit Repair Software CRM for mortgage brokers and entrepreneurs. Nothing to install. Access on any internet device. Try it FREE! |

||

|

Credit-Aid Software - America's most popular credit repair software. Everything you need

to launch, manage and run a successful and lucrative credit repair business!

|

|

|

|

|

|

American Credit Repair Academy - Learn to make unlimited revenue with your own Credit Repair

Business. Learn the advanced skills of credit repair; How to get clients fast

and receive a steady flow of paid referrals, plus proven methods to use the

law in your favor to remove difficult items and achieve a high credit repair

success rate.

|

|

|

|

|

|

Credit Repair Software Reseller - Have potential clients who would rather do-it-themselves? Offer

them your own brand of credit repair software in your own web store!

Buy at wholesale, set any price and CHOOSE YOUR PROFIT! Offer to refund the

cost of the software if they come back for your services -- 9 times out of 10

they'll return. |

|

|

|

|

|

MyCreditRepairSite.com - Instant Hosting and Website for Credit Repair Professionals. An Instant Credit Repair Business site all prewritten and ready for you to

start your business (not replicated). Customize as you like and choose your

own domain name.**SPECIAL OFFER FOR STUDENTS: Use code CREDITAID2 for 2

months FREE hosting!

|

|

|

|

|

|

Credit Card Processing for Credit Services - Apply for a Merchant Account to process credit card payments from

your clients. **RECOMMENDED FOR STUDENTS: Rates depend upon your

credit. More info and download an application here: http://www.credit-aid.com/creditcards.htm

|

|

|

|

|

|

CreditKarma.com - We love this site. Free (really free) credit scores and a fantastic

"what-if" simulator.

|

|

|

|

|

|

BondsExpress - Information and resource for surety bonds.

|

|

|

|

|

|

Kall8.com - Need

a $2 Toll-Free number, online fax or a Virtual PBX Phone System? This is who

we use in our offices and we love them. They will sell you a toll free number

for $2 a month. It also receives faxes! You can't beat this deal.

|

CONTACT US

We give you more than just software and training. We have a mission when it comes to support: Be extraordinary! When you buy our software, what you get goes well beyond what you expect from a software company.

We offer coaches and counselors to help you with the business of Credit Repair. We are here to help you to launch a successful business, not just learn a piece of software.

Our Address:

Credit-Aid Software / American Credit Repair Academy

10866 Washington Blvd. #447

Culver City, CA 90232, USA

www.americancreditrepairacademy.com

http://www.credit-aid.com

http://support.credit-aid.com

Thank You!

To all our students and software users. Without the support

and feedback of those who download and buy our software, we wouldn’t be here. We

are very lucky to have had so many people over the years think our software helps

their business and is easy to use, and we are proud that you still do. Thank

you, everyone!

For Additional information

Visit our user forums (http://support.credit-aid.com/forums), check out the articles and tutorials in our online Knowledge Base (http://support.credit-aid.com)

NOTES:

Hour 1

Hour 2

Would you like to earn revenue from your website?

Would you like to earn revenue from your website?